FAQs

-

What are your hours?

Lobby:

Monday – Thursday 8:30am – 4:00pm (ET)

Friday 8:30am – 5:00pm (ET)

Saturday 8:30am – 12:00pm (ET)Drive-thru:

Monday – Thursday 8:30am – 5:00pm (ET)

Friday 8:30am – 5:30pm (ET)

Saturday 8:30am – 12:00pm (ET) -

Where are you located?

425 Main Street

Caldwell, OH 43724

(740) 732-5678 -

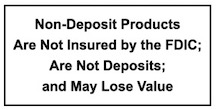

Are deposits insured?

Customer deposits are insured up to the maximum amounts permitted by the Federal Deposit Insurance Corporation. In general, each depositor is insured up to $250,000, however, balances in different account types are often insured separately, allowing families to keep a large amount of their savings at one bank.

-

How can we reach you?

You can reach us by sending us a message through the contact us link on this web site, calling us at 740.732.5678.

-

Does Community Savings sell or distribute customer information to third parties or other affiliates?

No we do not. Community Savings has a policy of not providing our customers’ information to any affiliated or non-affiliated third parties. Our complete privacy policy can be found on this site.

-

How can I apply for an account?

Apply here or apply in person at our branch, located at 425 Main Street in Caldwell, OH.

Please visit our Checking and Savings menus on our website to learn more about our products. You can apply on our website or apply in person at our branch, located at 425 Main Street in Caldwell, OH.

-

What is the minimum balance for your free checking account?

When selecting the MyChoice checking account at Community Savings, no minimum balance is required to maintain your account.

-

Does the bank offer a debit card?

Yes we do! We offer a Mastercard Debit Card with all of our personal checking accounts. The card is accepted anywhere Mastercard is accepted and at Automated Teller Machines around the world. There are no Community Savings usage fees associated with this card.

-

Where is the bank’s ATM?

Our ATM is located at our very convenient office location, 425 Main Street, Caldwell, Ohio.

Access 40,000 conveniently located ATMs throughout the nation. Find an ATM near you. -

How do I report a lost or stolen ATM or Debit card?

To report a card lost or stolen, please call 1-800-472-3272.

-

Does the bank offer Individual Retirement Accounts?

Yes we do! Community Savings offers a high-rate certificate of deposit IRA.